Student Loan Repayment Metrics – Best Optimize Payments!

Published: 14 Dec 2024

What is defined as student loan repayment metrics?

There are different metrics of student loan repayment that mean a number of indicators describing the state of student loan repayments. These are useful in understanding student debt and if you are on track to pay it off, how fast and how much interest you are paying.

Some common student loan repayment metrics include:

- Loan Balance: The present balance of your student loan which He or she intends to reimburse to the faculty.

- Interest Rate: The interest in percentage that your lender charges for lending you the money on an annual basis.

- Monthly Payment: The constant type of payment that you make out of which cuts down your loan balance.

- Repayment Term: The type of loan and the length of time you agreed to pay back the money within a period of 10 years though this depends on the repayment method agreed.

Student Loan Repayment Metrics – Track & Optimize Payments

| Loan Type | Monthly Payment | Interest Rate | Repayment Term | Remaining Balance |

|---|---|---|---|---|

| Federal Student Loan | $300 | 4.5% | 10 Years | $10,000 |

| Private Student Loan | $400 | 6.2% | 8 Years | $15,000 |

| Income-Driven Repayment | $250 | 5.0% | 25 Years | $8,500 |

| Graduated Repayment Plan | $350 | 3.8% | 12 Years | $12,000 |

Total Interest Paid: The interest rate continually of charges that you will be required to make over the elapsed period of time of credit.

Prepayment: A payment made towards your loan that is made in addition to your regular monthly installments offered by the company.

By monitoring these metrics borrowers are able to evaluate the effectiveness of their current strategy for repayment of the student loan and find potential weaknesses.

Why Is The Data on Student Loan Repayment Relevant?

Understanding and tracking student loan repayment metrics is crucial for several reasons:

1. Measure Financial Progress

If you will continuously check these factors, you can monitor on how you are in paying off your student loan. The breakdown of the monthly payment to represent the portion of payment that is going towards the principal amount and the part that goes to the interest helps you see where your money is being used and how effective you are at paying off the loan.

2. Optimize Loan Repayment

In an effort to pay more of your loan off ahead of time or lower the amount of interest you end up paying, tracking these repayment statistics enables you to do so. For instance extra payments towards the principal sum can help you lowered interest charges throughout the terms of the loan.

3. Don’t let them come due automatically or give the loan company the ability to automatically withdraw payment from your account.

Repayment metrics act as a reminder of the necessary payments that must be made towards the repayment of your loan so that in the event you missed making a payment you can easily know that you were supposed to make that particular payment. One is that failure to honor payments on time attracts penalties and reduces your credit score. It would also inform a person whether he or she is abreast with the repayment of the student loan.

4. Find out the areas within which there is possibility for refinancing or consolidation.

To appreciate or notice the need to refinance or consolidate your loans, you need to monitor your interest rates and loan balance appropriately. You can use refinancing to reduce the interest rate or shorten the years you will take to pay your loan hence cutting on costs.

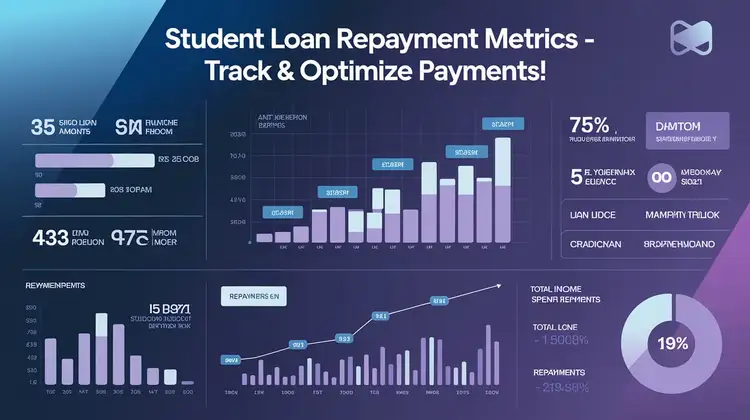

The important verticals which can be used in measuring the performance of student loans repayment include

There are several key metrics that you should focus on when managing your student loan repayment:

Loan Balance

Your loan balance is the aggregate of all the monies that you are required to pay your student loan. It is the easiest and most vital of all the metrics that explain your indebtedness levels. Managing your loan balance assists one in comprehending the remaining figure that they require to clear on the loan.

Monthly Payment Breakdown

The allocation of your monthly payment is vital since it lets you know what goes towards the principal and what goes toward the interest. Of course, it is preferable to pay more – as that will lead to a shorter time to be paid off which in turn means less interest will be charged.

Interest Rate

Your interest rate therefore defines how much more you will be charged besides the principal when taking a loan. Federal Loans as we have said before have a fixed interest rate while private loans may be of variable rate. Monitoring this factor is vital since you may want to know the better rate you are being offered for a refinancing.

Repayment Term

Repayment period is the number of years you choose or the period within which you will be required to repay your student loan. This term is usually given at 10 years but it can be adjusted according to types of loan or repayment schedule. The student loan metrics let you compute how some alteration in the term of student loan repayment—whether, it is shortened or lengthened—can cause the monthly required payment and how much total interest of the loan is to be paid.

Total Interest Paid

Hence the total interest paid: Total interest paid is important to know how much over your Loan amount, you end up paying for it over its lifetime. This one depends on your interest rate and your repayment term. The longer you take to retire the loan the higher the interest charges at the end of the loan period.

Prepayment

Paying an amount in advance should be adopted as a way of eliminating your loan balance as early as possible. These are any sum paid over and above the minimum monthly installment to be paid. It is useful to monitor the prepayments for they illustrate just how much of an impact extra payments can make in alleviating one’s obligation.

Ways of Measuring Your Student Loan Repayment Statistics

Keeping record of your student loan repayment metrics is not as complicated as most people would assume. There are a variety of tools and resources available to help you stay on top of your student loan repayment:

1. A Student Loan Tracker App

Currently, there are some applications created directly to assist borrowers with the issue of tracking their student loans and they include Loan Buddy, Student Loan Hero and Mint. These apps can track balance on the loan, interest rate, monthly payments and many others. They also may alert you to the due dates for a payment in order to assist you in managing your loan period.

2. Go to Your loan servicer’s website homepage

Almost all federal and private student loan companies will offer borrowers a loan portal that lets you monitor your loan repayment plan. These include the balance of your loan as well as checking on your monthly instalment and even the ability to switch your repayment method on the dashboard.

3. Excel Spreadsheet

However, if you have the type that wants to be more involved, you can probably use an Excel spreadsheet in tracking the loans. It lets you type in your loan details, keep an eye on your progress and even work out how repayments will affect the timing to pay off the loan.

4.Loan Repayment Calculator.

Federal loan servicers as well as other websites have tools that include student loan repayment calculators. On the basis of these tools, it is possible to calculate the monthly payments, the time it will take to pay the loan and the interest which have to be paid depending on different evaluating options

Student Loan Repayment Options – Track & Optimize Payments

| Loan Type | Eligibility | Monthly Payment |

|---|---|---|

| Standard Repayment Plan | US Citizen, Enrolled in School | $200 – $500 |

| Income-Driven Repayment | Low to Moderate Income | Varies Based on Income |

| Extended Repayment Plan | Minimum Loan Balance | $100 – $300 |

| Graduated Repayment Plan | Any Credit Score | Starting Low, Increasing Over Time |

Strategies toward Making the Most of Your Student Loan Repayment

After you have carefully measured your student loan repayment metrics the next thing you do is to manage your repayment system. Below are several tips on how to pay off your loans faster, reduce the interest you pay and ultimately achieve financial freedom sooner:

1. Make Extra Payments

AVAILABILITY OF EXTRA PAYMENTS FOR PRINCIPAL In this case, a number of additional payments can be made directly on the loan balance. When applied towards the principal in additional payments, you avoid the interest that builds up within the period of a loan, thus paying off your debt more promptly.

2. Refinance Your Loans

It can also help you to manage your private student loans, as you can take up a loan to refinance your loan in the hope of getting a better interest rate. When refinancing you can repay less every month, do it in a shorter time and be charged less in interest. Just bear in mind to compare with other companies to attain the best rates and terms before going for refinancing.

3. Pay More Than the Minimum

To avoid high interest rates attaching to the balance, it’s always advisable to pay more than the minimum that has been stated. Every additional sum even a smaller one can help a lot because it decreases the general interest and the payment time of the loan.

4. When taking a loan it is important to choose a repayment plan that one is comfortable with financially.

Federal student loans have a number of plans you can pay off your student loans including the Income-Driven Repayment (IDR) plans. These plans can also alter the monthly cost depending on your income – learning easier for you if you are experiencing some financial difficulty. However, it is worth noting as expected, extended offers of repayment periods increases the total interest costs in the long run.

5. Automate Your Payments

It is common for several loan servicers to give rebates on the interest rates to those individuals who pay via automatic plans. Paying by credit also avoid punctual promissory noting the due dates in an attempt to avoid being penalized for being late as a result maintaining a good credit score.

Conclusion

Monitoring and even the best record of the student loan repayment indicators is crucial for efficient handling of the debt, as well as the attainment of real financial freedom. This means by keeping track with certain fundamentals like balance on the loan, the interest charge, the monthly installments you are in a position to make rational decisions that assist to shield you from paying high interests and acquiring your loan repaid on time. No matter whether you go for additional payments, refinancing or changing your payment plan, the fact of regaining control over student loans’ repayment will result in more prosperous life.

FAQs

How can I keep track of my student loan repayment?

The easiest and most efficient way to keep track of your student loan repayment is by using a student loan tracking app or simply signing into your loan servicer website. These tools offer the features such as balance sheets of loan, payment and interest, offering real-time updates as well.

What can I do to pay off my student loan effectively?

To manage your student loan repayment strategies and pay as much as you can on your student loan, try the following tips: pay some amount more than your monthly installments known as the principal, take a loan with a lower interest rate and select a repayment plan depending on your wage.

What is the fixed student loan interest rate?

The Federal student loans used in this study attract an average interest rate of between 3.73% and 7.08% depending on the type and disbursement date of the loan. Even though they offer a cheaper way for funding college expenses, private student loans averagely come at a higher interest rate depending on credit score and provider bank.

How can I pay off my student loan earlier?

Yes, you can decrease the balance on your student loans much faster using methods of prepayments and paying additional to the required monthly installments. Another factor that can help you for shorter loan repayment is to refinance your loan at a lower interest rate.

What would happen if they missed a payment on their student loan?

Failure to pay will attract fees, has a negative impact on your credit standing and in the case of federal loans, lead to defaulting. As for the DTH level, it is indispensable to schedule the regular payments and avoid the deadline’s miss.

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks

- Be Respectful

- Stay Relevant

- Stay Positive

- True Feedback

- Encourage Discussion

- Avoid Spamming

- No Fake News

- Don't Copy-Paste

- No Personal Attacks